Why Ethereum dominates NFTs

Most alt-L1s don’t have meaningful NFT activity still, here’s why!

Metaversal is a Bankless newsletter for weekly level-ups on NFTs, virtual worlds, & collectibles

Dear Bankless Nation,

Over the past two years the cryptoeconomy has opened up a lot.

In that span, we’ve seen the DeFi and NFT scenes surge to new heights atop Ethereum, plus various attempts to replicate the success of these arenas on other chains.

Some of these alt-L1s, like Fantom, Terra, and Binance Smart Chain, have in fact managed to gain non-trivial market shares in the DeFi ecosystem. Yet Ethereum and its scaling solutions continue to totally wallop the competition when it comes to NFT activity levels.

Why does Ethereum remain so dominant around NFTs, then? I offer some considerations here for today’s Metaversal,

-WMP

🙏 Sponsor: Polygon Studios—Fostering culture across Gaming, NFTs, and the Metaverse✨

How Ethereum remains the NFT leader

According to my rough calculations, Ethereum and its top scaling solutions like the Polygon PoS sidechain and Arbitrum currently account for roughly 60% of the total value locked, or TVL, across all of DeFi.

That stat’s certainly nothing to sneeze at, but then again neither is the 40% DeFi market share that alt-L1s (Solana, Avalanche, etc.) have managed to claw up in recent times.

These alt-L1s rose to newfound prominence in 2021, when massive demand for Ethereum blockspace priced out many DeFi users and sent them searching for cheaper alternatives.

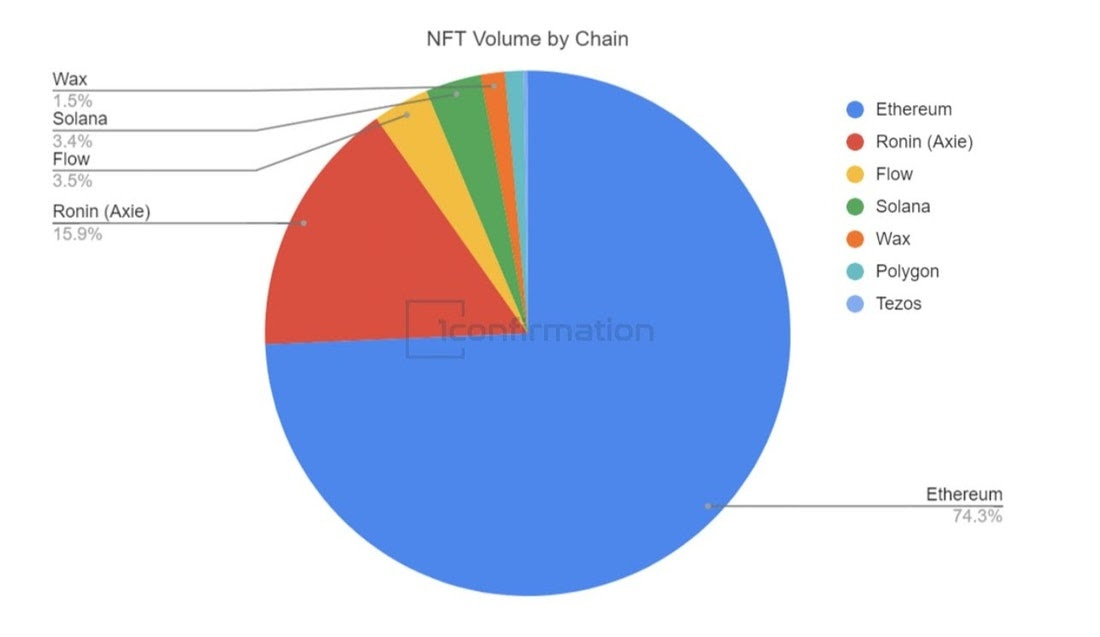

In contrast, though, Ethereum has held its ground quite well in maintaining its centrality in the NFT ecosystem. According to 1confirmation’s 2021 NFT Year in Review report, by the end of last year Ethereum and its scaling solutions still accounted for over 90% of NFT trading volume.

Of course, it’s possible that alt-L1s have only just entered the NFT cultural “arms race” and that Ethereum’s market share dominance will narrow further like we’ve seen in DeFi.

Yet what if it’s just fundamentally harder to replicate the success of Ethereum’s NFT ecosystem? And what if we’re approaching a sort of crossover point with the maturation of L2s that will lead to Ethereum gaining exponentially more NFT activity from here?

I think the answers to those questions are “It is” and “It’s happening.” But more specifically, let’s zoom in and touch on the factors that are potently working in Ethereum’s favor when it comes to NFTs today and going forward.

Best infra and money

Ethereum’s the first-mover smart contract platform and has accrued huge infrastructure and tooling advances over the years. In this regard, NFT users on Ethereum have vastly more apps and resources to benefit from or leverage. Additionally, nowadays it’s safe to say ETH is the best money in the cryptoeconomy, thus it’s no surprise most NFT activity remains denominated in ETH.

Best and brightest

Ethereum has the largest and most active community of developers and creatives in crypto. Thus whether it comes to bleeding-edge L2 research matters or next-gen NFT cultural experiments, Ethereum is the definitive and organic capital of the cryptoeconomy right now. Replicating or matching this talent en masse is no small feat and never will be.

Best liquidity

Superior infra + the most pioneering users = the best NFT liquidity in the cryptoeconomy today by a long shot. And while the NFT bridging tech space remains so primitive, there’s this “moat effect” happening where most new NFT projects launch and operate on Ethereum because it’s where all meaningful liquidity is currently at. And having the most liquidity has translated into offering the most opportunities, both for regular NFT users and NFT projects alike.

Best provenance and security

Ethereum’s first NFT projects started in 2015. In other words, Ethereum’s NFT scene has the richest history and vastly predates the NFT scenes of all Ethereum’s contemporary alt-L1 competitors. Ethereum has maintained perfect uptime throughout its life, too, so it has the longest and most proven track record of reliably securing NFTs to date.

Best quality

Because of their compelling history and dependability, Ethereum ERC-721 NFTs are considered by many NFT collectors to be the most desirable NFTs around. So when it comes to users wanting the best NFTs from the most interesting projects, other chains’ NFTs simply can’t compete in perceived quality at the moment, at least in more than a few users’ eyes.

Best future prospects

Combine Ethereum’s provenance and security with its future development roadmap, and what do you get? High confidence from many NFTers that Ethereum, and in extension Ethereum scaling solutions, will be reliable and fruitful centers of NFT activity for years to come.

The big picture

Things change, and it’s definitely possible that over time Ethereum starts to increasingly cede some of these key NFT ecosystem advantages. Yet for now these advantages remain in place in big ways, and with coming advances around L2s (e.g. even more frictionless UX) I think there’s strong chances that Ethereum’s dominance around NFTs grows even further from here.

Action steps

🤔 Did I miss any reasons for Ethereum’s sustained NFT dominance? Let me know in the comments below!

📰 Read my previous post That NFT you like’s in style if you missed it!

Author Bio

William M. Peaster is a professional writer and creator of Metaversal—a Bankless newsletter focused on the emergence of NFTs in the cryptoeconomy. He’s also recently been contributing content to Bankless, DeFi Pulse, JPG, and beyond!

Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge.

🙏Thanks to our sponsor

POLYGON STUDIOS

Polygon Studios is on a mission to help build digital culture, play-to-earn gaming, NFTs, and the Metaverse ecosystem on Polygon. Some of the key projects supported by Polygon Studios include The Sandbox, Skyweaver, Big Time, Crypto Unicorns, and Decentraland—among others. Polygon Studios also helps fundraising & onboarding. Check it out here.

Stay updated on the latest amazing gaming, NFT, and metaverse projects:

👉 Join the Polygon Studios Discord

👉 Follow Polygon Studios on Twitter

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

Ok. Ethereum L1 and NFTs dominate. I can see that. Great article, sound reasoning as almost all other articles. All thumbs up.

Could you elaborate in a future article how you see L2 and NFTs - particularly those attempts where L1 NFT is kind of "escrowed" and then sell process (and fees) are done on L2?

I believe Trove by Treasure are currently attempting something like that?

No criticism of your case for Ethereum. The challenge I am having is trying to determine how L-1 protocols are capturing value from an investment perspective. It seems the value accrues to users much like the renewable energy sector.