The Axie Infinity Boom

Popular NFT game Axie Infinity is gaining some serious adoption!

Metaversal is a Bankless newsletter for weekly level-ups on NFTs, virtual worlds, & collectibles

Dear Bankless Nation,

There’s an NFT project that’s dominating the entire dapp space right now when it comes to 30-day protocol revenues. Indeed, not even Ethereum’s biggest DeFi heavyweights can match this game’s numbers at the moment!

The prodigious project in question? Axie Infinity.

The pioneering play-to-earn NFT game is redefining how many people think about and approach the cryptoeconomy, and it’s got the stats to prove it.

Let’s dig into some of these stats today, as something special is happening 💫

-WMP

🙏 Sponsor: Upshot—get paid to appraise NFTs. Start now!

The Axie Boom

Axie Infinity, a digital pets battle adventure, is Ethereum’s most popular game and among Ethereum’s most lucrative dapps right now.

For those not familiar with the title, Axie Infinity players breed, collect, battle, and trade their pet Axie monsters, and with nearly 300,000 daily active users (DAUs) the game’s breeding and marketplace fees are now seriously starting to stack up.

Indeed, crypto data platform Token Terminal’s 30-day protocol revenue dashboard shows that as of yesterday Axie Infinity facilitated +$11 million in cumulative protocol revenues over the past 30 days. Woah.

To put that into perspective, Axie Infinity is currently generating more 30-day protocol revenues than top DeFi apps like lending protocol Maker ($8.4M) and decentralized exchanges Sushi ($6.3M) and Curve ($3.6M)! As such, Axie Infinity presently accounts for no less than 20% of the total protocol revenues generated by all the dapp’s Token Terminal tracks right now.

These are really impressive numbers, and they remind me of a recent comment from Axie Infinity co-founder and COO Aleksander Larsen: “Fun games will bring blockchain technology to the masses.”

Notably, this Axie Infinity surge has been powered in no small part by the recent arrival of the game’s bespoke Ronin sidechain, which has brought near-free and near-instant transactions to the Axie economy. I’ve personally tried Ronin, and it’s easy to use and comparable to bridging money to Polygon experience-wise.

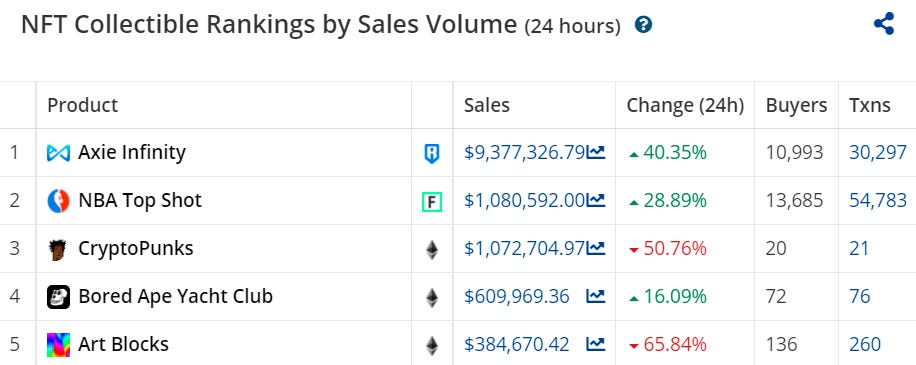

This improved UX has led to a frenzy of trading lately, and you don’t have to look any further than Axie Infinity’s sales volume over the last day for stark evidence of that. Per Cryptoslam the game just facilitated over $9.3M worth of 24-hour sales, blowing the nearest oncomers NBA Top Shot ($1.08M) and CryptoPunks ($1.07M) out of the water in the same span.

Zooming out, this trading frenzy is channeling into an activity frenzy that in turn is channeling into a revenue frenzy. What’s interesting, too, is that once Axie Infinity’s AXS staking system is activated these revenues will start flowing to the game’s users and stewards, i.e. AXS holders. What a stream that’s poised to be, since Axie Infinity literally enjoys the best cash flow of all dapps currently!

Yet it’s far from all about the money. Axie Infinity is a great game in and of itself, and it’s also one of Ethereum’s best stories right now. That’s a major reason why people are flocking to the project’s Discord and even eSports teams are starting to take notice.

If this is how fast and high Axie Infinity can climb in a nascent NFT ecosystem, then it seems the sky’s truly the limit for NFT gaming going forward.

Action steps

👀 Check out Axie Infinity’s Getting Started guide!

Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge.

🙏Thanks to our sponsor

UPSHOT

Get paid to appraise NFTs with Upshot!

Upshot is a protocol that pays NFT experts and collectors for honest insights - unlocking opportunities for a new generation of appraisers to capture value from their expertise and enabling a wave of powerful new DeFi primitives.

👉 Visit Upshot.io and start appraising NFTs today!

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.