The NFT Royalties Landscape 🤔

Navigating the uncertainty around royalties!

Metaversal is a Bankless newsletter for weekly level-ups on NFTs, virtual worlds, and more!

Dear Bankless Nation,

Once a straightforward process, the enforcement of NFT royalties has become a contentious issue as more platforms have shifted to making royalties optional.

As we navigate this new era of uncertainty, it's key to understand the shifts in royalty practices and explore creative solutions that empower artists while preserving the decentralized ethos at the heart of NFTs.

In this post, we'll go over a timeline of how we got here and workarounds that can keep the magic of NFTs alive for creatives!

Let’s get to it.

-WMP

🙏 Sponsor: Uniswap Labs — Better Prices, More Listings: NFTs on Uniswap✨

Understanding NFT royalties today

The context

There was a time a few years ago when OpenSea was the only NFT marketplace around. If an NFT sold during that time, it undoubtedly sold on OpenSea.

In this environment, if you were a creator and set a 10% royalty rate on OpenSea, then you made a 10% cut any time one of your pieces resold in a secondary sale. Pretty cool, right?

Pretty cool indeed, and that was a reality that attracted many artists to NFTs during the 2021 bull run. But royalty payments here started cratering last year, so here’s a quick timeline of events that have brought us to where we are today:

July 2022 — sudoswap, previously an over-the-counter (OTC) NFT trading app, launched its automated market maker (AMM) protocol, initially without enforcement of NFT royalties on secondary sales.

October 2022 — Blur, an “NFT marketplace for pro traders,” launched, and also initially without any NFT royalties enforced; the platform quickly accrued major trading volume upon announcing plans for multiple rounds of $BLUR airdrops.

November 2022 — OpenSea launched the Operator Filter, code that collections could adopt in order to block trading of their NFTs on marketplaces that didn’t honor royalties at the time, e.g. Blur, LooksRare, NFTX, sudoswap, etc.; opting in to this filter became required if collections wanted their royalties enforced on OpenSea.

January 2023 — Blur tapped into OpenSea’s Seaport marketplace protocol to bypass the Operator Filter, making it so that NFTs could be traded and a minimum royalty rate of 0.5% enforced across both Blur and OpenSea; ironically, creators had to block Blur via the Operator Filter to use its parallel Seaport workaround.

February 2023 — OpenSea temporarily dropped its marketplace fee to 0% and introduced optional royalty payments, with enforcement of a minimum 0.5% rate if buyers didn’t volunteer to do more.

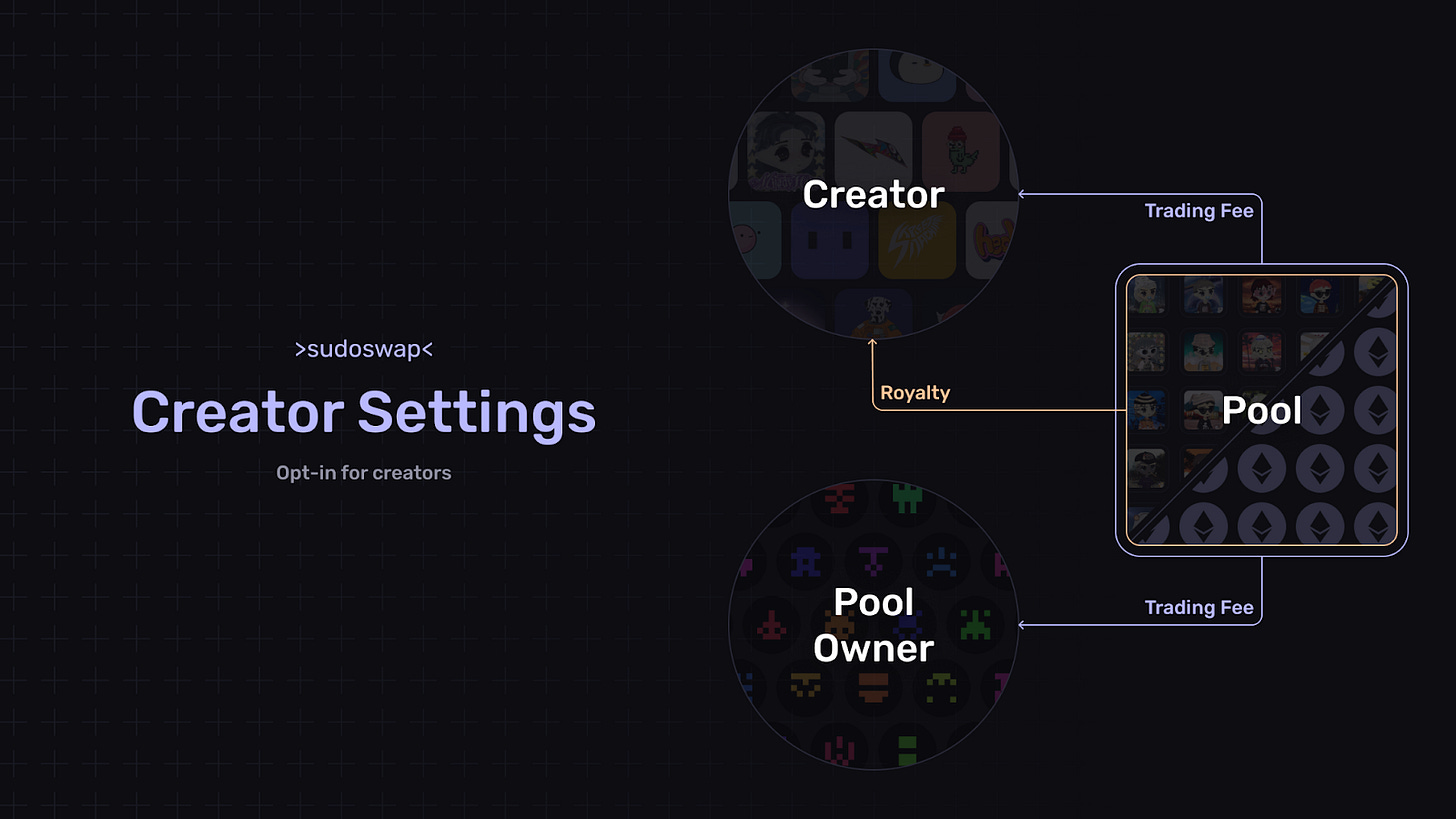

June 2023 — sudoswap introduced its v2 protocol with native support for onchain royalties via ERC2981 and Manifold’s Royalty Registry; thus the project some credited with kickstarting the race to 0% royalties has now come full circle and come out swinging with programmatic support for them.

August 2023 — OpenSea announced plans to sunset its Operator Filter due to a lack of “buy-in of everyone in the web3 ecosystem,” adding that it would push ahead with optional NFT royalties and would work to highlight a “creator’s preferred fee” for both buyers and sellers.

🔒 You're a free user and don't have access to Airdrop Hunter

If you needed a reason to upgrade to a paid membership, this is it. A single airdrop can pay for an annual membership's cost many times over!

What are creators to do? Some ways forward

Ultimately, OpenSea and Blur have made NFT royalties optional on their platforms to maintain price competitiveness.

As things stand amid this battle for the best prices, it seems unlikely these juggernauts will be doubling back to support full, creator-set royalties any time soon.

To adjust to this new era of uncertainty around royalties, then, creatives working around NFTs can consider a range of options. Here I’d point you to:

📦 Holding back supply — Manually or programmatically mint 1/1s or editions to your wallet during drops for potential secondary marketplace sales later.

⏲️ Zora’s Auto-Reserve — An opt-in system creators can use to automatically mint NFTs from their own drops to their wallets at regularly scheduled intervals, e.g. every 10th mint.

🛠️ DIY marketplaces — Build your own royalty-friendly marketplace for your collection; on the simpler side here are no-code solutions like Rarible’s Community Marketplaces builder, while Reservoir offers more advanced possibilities for devs.

🎨 Use pro-royalty platforms — Focus your efforts around projects that continue to fully honor NFT royalties, including Art Blocks, Foundation, KnownOrigin, Manifold, Nifty Gateway, Rarible, sudoswap v2, SuperRare, and Zora.

Manifold’s Royalty Registry — The Royalty Registry x Royalty Engine combo is an opt-in onchain royalty system; it lets projects configure their royalty settings and participating marketplaces to search for these settings in order to honor them.

sudoswap’s Creator Settings — This new smart contract system lets NFT creators offer reduced royalties in exchange for a share of trading fees from sudoswap liquidity pools; it’s highly flexible, with customizable liquidity-lockup periods and beyond.

Earn via tading fees — For example, it’s entirely possible on sudoswap to set up a liquidity pool of many ERC1155 NFT editions and then earn from buys and sells made through the pool over time.

Infinity mints — Visualize Value recently pioneered the Infinity collection format, where a drop’s mint funds are stored in a smart contract and are 100% withdrawable if a collector ever wants to sell their piece later; a creator could use this format with, say, a 5% mint tax so they can earn while still offering 95% refunds to collectors at any time.

Not so simple, but we fight on

NFT royalties are never comprehensively enforceable. For example, recall that the Royalty Registry system is opt-in. In kind, offchain systems are also obviously voluntary and major platforms like Blur and OpenSea have deemphasized them in a race to the bottom fees-wise.

Additionally, as Foobar has previously noted in “On Royalties,” common suggestions to enforce royalties, such as hardcoding transfer fees into tokens or blacklisting marketplaces, can break essential NFT practices like free wallet-to-wallet transfers or be easily circumvented, e.g. via “wrapper” smart contracts.

DCInvestor once said (and Foobar highlighted in the aforementioned post) that “NFTs are best as permissionless, censorship-resistant bearer assets,” i.e. they’re most compelling when owners enjoy full ownership that can’t be undone. Steam can rug your games assets, not your NFTs, Instagram can rug your art, not your cryptoart, X (formerly Twitter) can rug your username, not your ENS, etc.

The answer here isn’t unlimited centralized god mode, in which creators can burn holders’ NFTs and so forth. It’s in committing to or doubling down on the workarounds mentioned in the previous section of this write-up so that creators can remain empowered while also supporting and tapping into the quintessential magic of NFTs!

Action steps

Explore alternative solutions: Create your own NFT marketplace 🛠️

Catch up on my previous weekly roundup: Rocking the NFT Royalties Boat 🌊

Author Bio

William M. Peaster is the creator of Metaversal — a Bankless newsletter focused on the emergence of NFTs in the cryptoeconomy. He’s also a senior writer for the main Bankless newsletter.

A Bankless Citizen ⚑ turned $264 into $6,077 last year. A 22x ROI 🚀 in a bear market!

🙏Thanks to our sponsor

UNISWAP LABS

Trade NFTs across major marketplaces to find more listings at better prices. NFTs on Uniswap are open-source, trustless, and self-custodial. To celebrate NFTs on Uniswap, we are airdropping $5 million to certain historical Genie users. Start trading NFTs today on Uniswap.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

5% Infinity Mints... i like your idea