Earning on MetaStreet 🏦

The basics of MetaStreet lending!

Metaversal is a Bankless newsletter for weekly level-ups on NFTs and the onchain frontier

Dear Bankless Nation,

MetaStreet is a rising force in the NFT lending sector, offering easy-to-use features for newcomers and seasoned DeFi veterans alike.

For today’s post, let's run through how the project works and how you can consider its Earn platform if you’re currently looking for ETH yield opps in NFT land!

-WMP

🦊 Thanks to MetaMask Portfolio 🦊

👉 Everything you need in one place ✨

An Intro to MetaStreet 🔍

What’s MetaStreet?

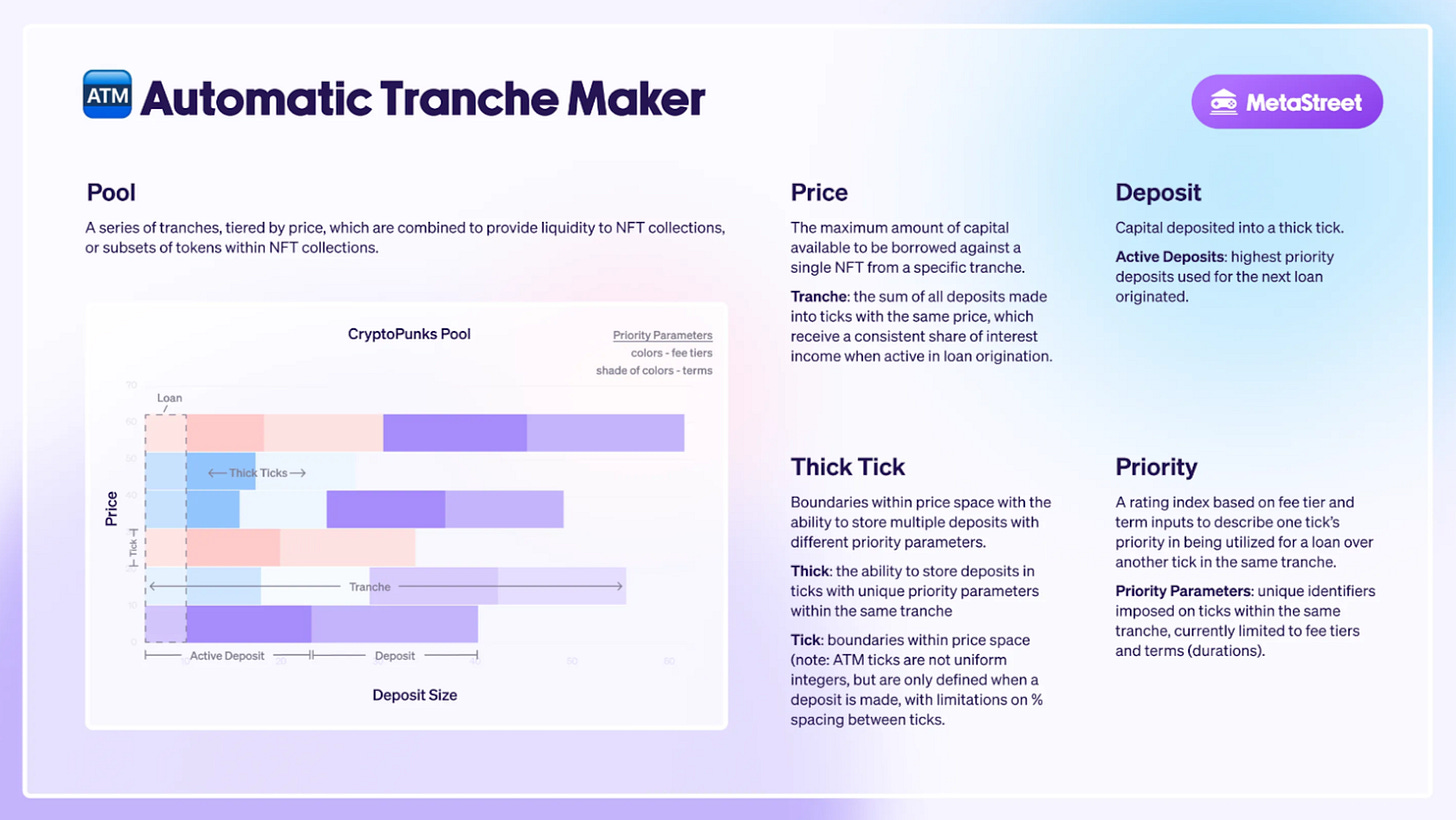

MetaStreet, known for its Automatic Tranche Maker (ATM) system, is a “liquidity scaling” project that has carved a niche in the NFT lending space.

In other words, it’s a permissionless lending protocol that allows for the creation of onchain lending pools around NFTs. These pools are distinct in that they organize capital based on varying risk and rate profiles from NFT depositors, which then translate into fixed-duration loans for borrowers.

As of the latest data, the new MetaStreet V2, which was launched in June 2023, now has a total value locked (TVL) of approximately $15.26 million and has facilitated more than $58 million worth of loans to date.

Bankless Citizens who completed the Jito quest in our Airdrop Hunter tool just earned $15k or more 🏹

Don't miss the next one 👇

How the MetaStreet ATM works

MetaStreet's ATM system is an attempt to address some of the shortcomings of traditional lending protocols.

For example, it's designed to operate without a centralized price oracle, which removes a dependency and potential point of failure. Its dynamic interest rate model is another key feature, replacing fixed, governance-driven interest rates with a more fluid, deposit-driven approach.

Additionally, the permissionless nature of the protocol allows users to set up a lending pool for any NFT collection, which is naturally good for accessibility and flexibility.

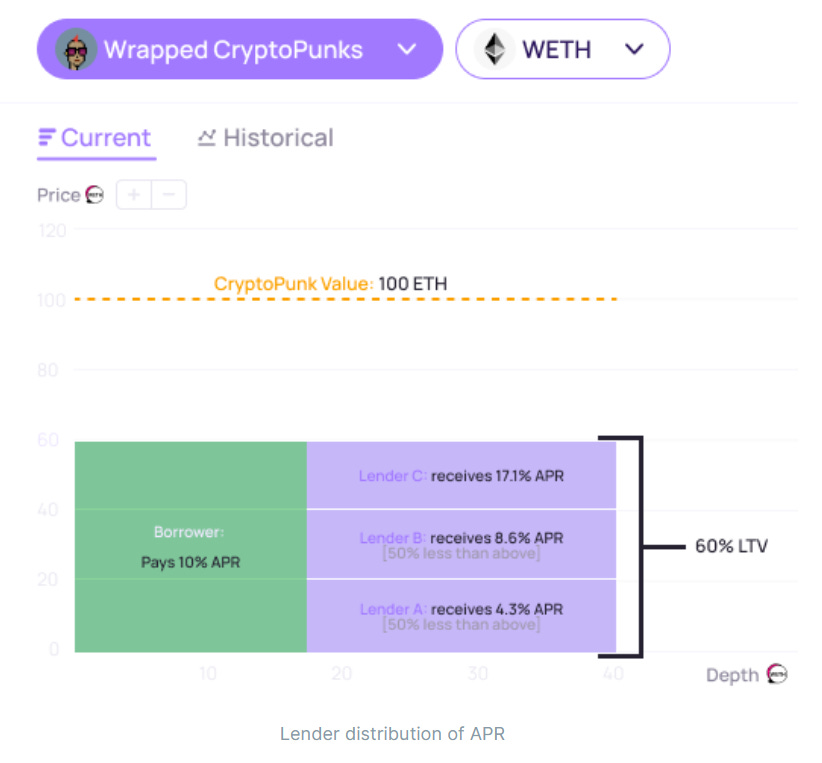

Zooming in a bit, note that the pools in MetaStreet aggregate capital based on price, term, and rate tier, before pooling all deposits together. This method ensures that lenders of all risk tolerances can participate, with low-risk lenders enjoying the security of insurance from high-risk lenders, and the latter benefiting from leveraged returns for taking on more risk.

In the event of a borrower default, the protocol employs a 24-hour auction for the underlying NFT in order to absorb and mitigate the originally borrowed sum.

How to get started with MetaStreet Earn

While borrowing is for more advanced users on MetaStreet, the project offers a MetaStreet Earn service that makes lending to its NFT-underpinned pools (and earning yield for doing so) straightforward.

If you’re curious to explore this opp, here are the steps it’d take to get started:

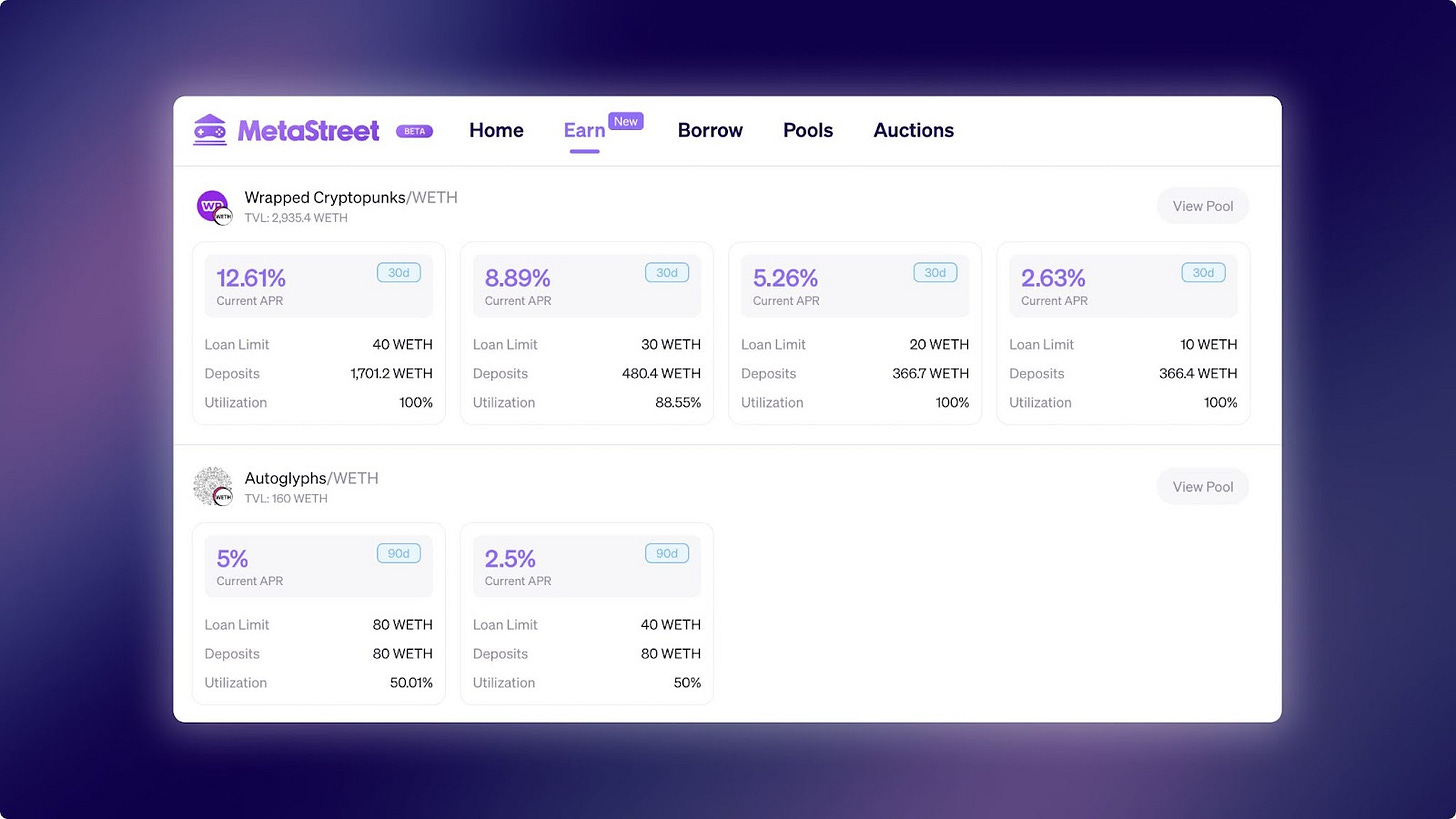

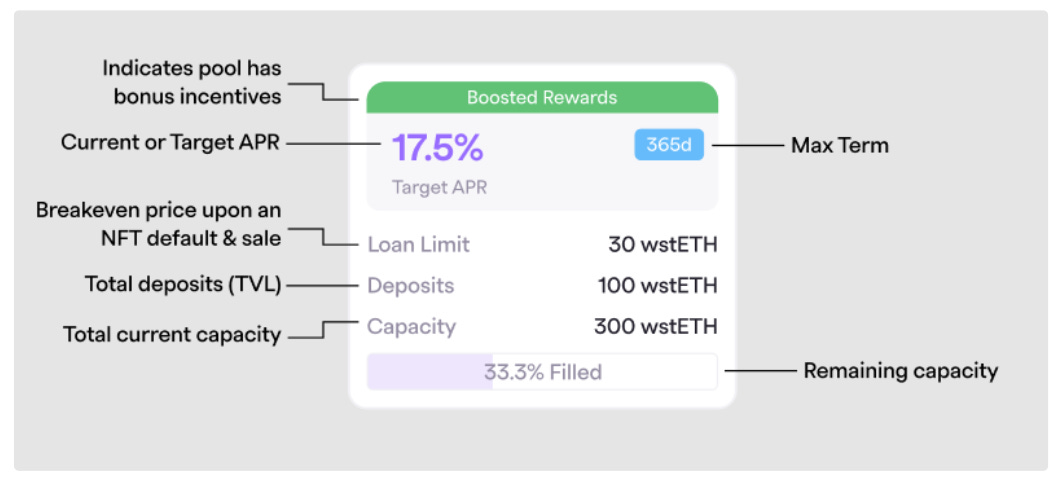

🏊 Explore Pools: Visit the MetaStreet Earn page to browse available pools. Each pool is associated with a specific NFT collection and has its own risk and reward parameters.

🌊 Select a Pool: Choose a pool based on your preference for the deposit token, the APR (annual percentage rate), and other factors like the associated NFT collection.

🪙 Deposit capital: Decide on the amount you wish to lend and deposit it into the selected pool. You’ll use your wallet to 1) approve the deposit token, e.g. Wrapped ETH (WETH), and then 2) fire off the final deposit confirmation transaction.

🤲 Start earning: Once your crypto is deposited, you’d start earning yield based on that particular pool's performance and terms. You can track your earnings and other key stats over time via the “My Positions” tab on the Pools page.

Of course, lending isn’t for the faint of heart as there are potential risks here, e.g. the specter of market failures or smart contract vulnerabilities. The MetaStreet V2 architecture has been audited twice already, but still, if you do try the protocol only deposit what you can afford to lose in these early days just to be safe.

What to watch going forward

MetaStreet is promising, but it also has serious competition from other contemporary mainstay NFT lending protocols like Bend DAO ($52M TVL), Blur Lending ($51M TVL), JPEG'd ($29M TVL), NFTfi.com ($17M TVL), and Arcade ($13M TVL).

That said, the project does have a potential ace up its sleeve. Unlike these competitors, all of which either have a live native token (BEND, BLUR, JPEG) or have announced plans for one (ARCD, NFTFI), MetaStreet has not yet introduced a native token.

This leaves room for a possible token launch, which could boost its traction and help it catch up with the higher TVLs and volumes of its larger competitors.

Will it happen? That remains to be seen. But regardless of any theoretical airdrop, MetaStreet's innovative ATM system and user-friendly Earn service makes it a strong contender in the NFT lending space on fundamentals alone. The protocol also seems poised to go multichain soon, which will make it that much more accessible.

Keep an eye on it as an up-and-comer at the crossroads of DeFi and NFTs accordingly!

Action steps

🎮 Catch up on my previous write-up: Time to Play

📚 Collect this post: Mint it on Mirror

Author Bio

William M. Peaster is the creator of Metaversal — a Bankless newsletter focused on the emergence of NFTs in the cryptoeconomy. He also serves as a senior writer for the main Bankless newsletter.

🙏 Together with 🦊 MetaMask Portfolio 🦊

Do more in web3, your way. MetaMask Portfolio provides secure, easy to use, and convenient access to web3 features and services in one place. View and manage your assets from your dashboard. You can also buy, sell, swap, stake, and bridge tokens!

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.