Inside The Metaverse Index

Metaversal talks with the creators of $MVI, Index Coop's first community-launched & NFT-focused index!

Metaversal is a Bankless newsletter for weekly level-ups on NFTs, virtual worlds, & collectibles

Dear Bankless Nation,

Index Coop is an up-and-coming DAO (“decentralized autonomous organization”) whose community specializes in creating cryptoeconomy index tokens.

All eyes are on Index Coop today accordingly as the project just launched its first NFT-centric product, The Metaverse Index ($MVI)!

So just like how DeFi has the DeFi Pulse Index, now the NFT economy has $MVI. The token is garnering no shortage of early interest because it gives users the ability to easily gain top-down, diversified exposure to Ethereum’s blossoming and NFT-driven metaverse scene, which is great for UX.

To get the inside scoop on how this new metaversal index works, then, I talked shop with the index’s co-authors and managers, Dark Forest Capital and Verto0912, to see what the $MVI is all about and how it was created. Interview below, enjoy!

-WMP

🙏 Sponsor: Nifty Gateway—buy, sell, and store NFTs!

Talking $MVI with Metaverse Index Managers Dark Forest Capital & Verto0912!

WMP

One of the rising stars of the Ethereum NFT ecosystem is Metaverse projects right now. Why do you think the Metaverse is having its day currently, what makes it so interesting and important?

MVI team

Humanity is increasingly spending time in virtual environments, whether those be Zoom, Fortnite battle sessions, Reddit, or any other social network. This trend is only accelerating with concepts like Gather, Clubhouse, and other digital spaces. Metaverses – digital worlds – built with blockchains offer a new social contract for our digital lives predicated upon digital ownership and free markets – two properties that are absent from existing games and digital platforms. Free markets facilitate creativity and value creation, while digital property rights ensure value developed in the market is imbued to the creators.

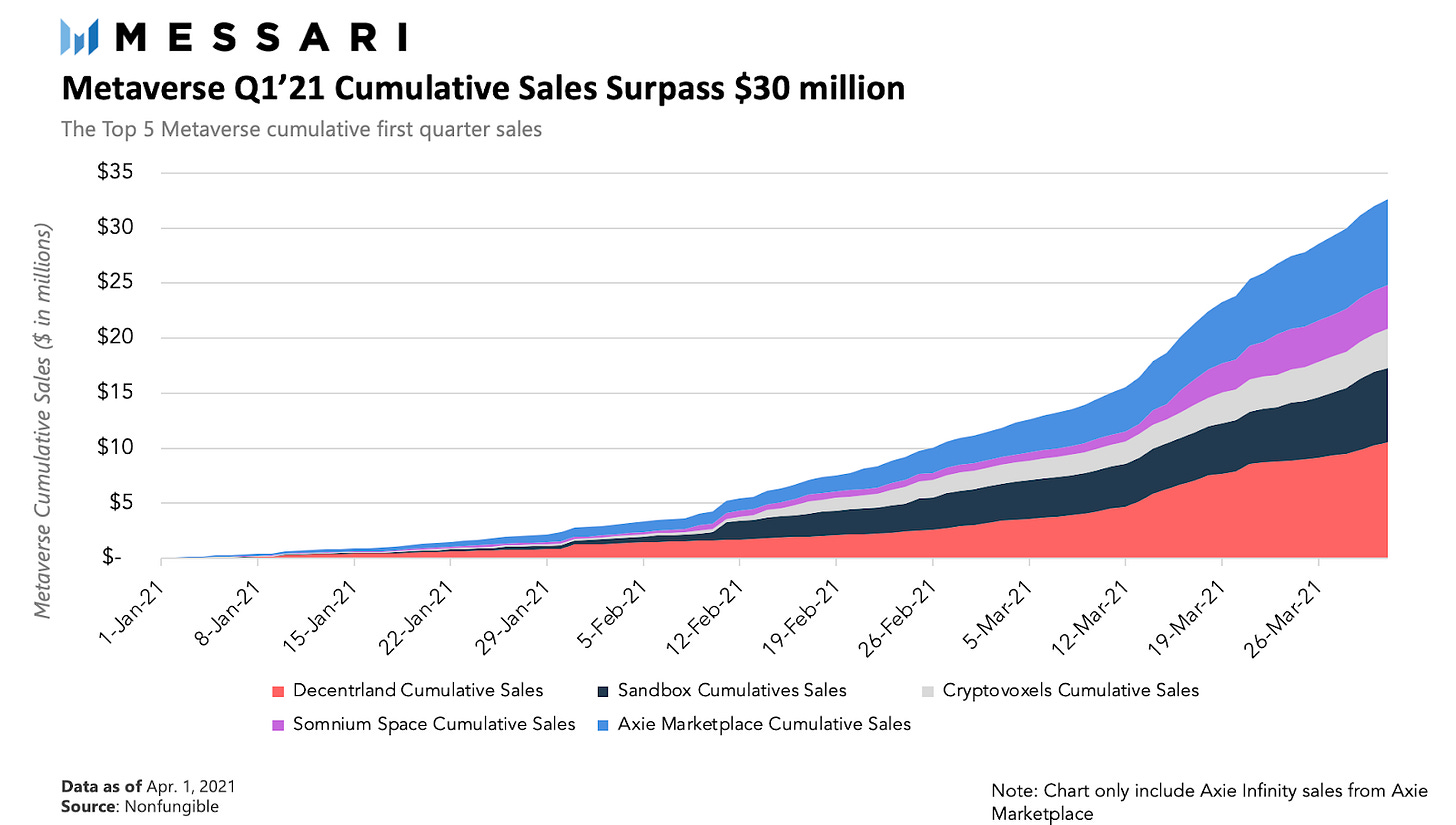

As they exist today, metaverses are digital outskirts – they’re sparsely populated, unsettled lands teeming with untapped potential. The early settlers of the outskirts are the crazies and the speculators. At the end of 2020, all time Metaverse sales exceeded $55 million ($20 million which came in 2020 alone). Within the first quarter of 2021, Metaverse sales have already surpassed $30 million.

As the metamorphosis continues, these metaverses that lie at the outskirts of our digital worlds will slowly evolve into bustling economies. Undoubtedly, there will be vast fortunes lost and made. But, when the dust finally settles and the transformation occurs, the value created will be profound.

WMP

A lot of people are looking at index fund products at the moment, particularly in the NFT arena. And now the MVI has stepped up to the plate. Can you walk me a little bit behind the scenes, what was the process of creating the MVI like? What went into it?

MVI team

It’s been 6 months in the making at this point. The idea was originally proposed in the first week of Index Coop’s existence by Dark Forest. The community focused on its flagship product, DPI, for the first few months and MVI fell by the wayside. It was with Verto’s arrival that we revisited the methodology and project liquidity had picked up, making it a more realistic proposition.

We reached out to a few people in the space to see if anyone was interested in partnering with the Coop like DeFi Pulse with DPI, or Coinshares with CGI, and connected with Mason. While Mason wasn’t able to partner with us in the traditional sense (he has a pretty solid position at Messari already!) he was keen to provide input and use his expertise to advise us on the latest happenings in the realm of the Metaverse.

So with expert input, a reworked methodology and the NFT space exploding, we dropped MVI into our product onboarding pipeline at Index Coop as the first “community led” product. Verto and I would take the reins full time but continue to contribute where possible to everyday Coop activities. MVI sailed through both of our community votes while in the background we started to reach out and get familiar with the projects that formed the index. This part was pretty humbling because despite being au-fait with DeFi, the NFT/gaming/social token sectors are a whole different kettle of fish! Each project has its own learning curve and the communities are quite unique.

Here we are coming up on launch and the last few weeks have been a blur. We are still far from experts in any of the 15 projects that make up MVI, but we’ve been making connections and learning fast. Some highlights so far:

Building up a team of Axies that couldn’t fight their way out of a paper bag

Perusing art galleries in Decentraland

Arranging the launch party in Decentral Games’ Tominoya Casino

Running a logo contest for MVI and seeing the creativity from the crypto community

Learning that users in this space don’t necessarily know what’s happening in DeFi, something that perhaps we took for granted

Being bombarded with twerking Pepe memes in the $MEME telegram channel

It’s been an unreal journey so far but seeing the excitement and passion people have for the product we couldn’t be happier with how it’s turned out. Right now we’re really looking forward to seeing MVI grow and help more people get exposure to a complicated and fast-growing sector.

WMP

The MVI tracks a range of different NFT projects. What’s the weightings of these projects like in the index, how does that work now and on an ongoing basis?

MVI team

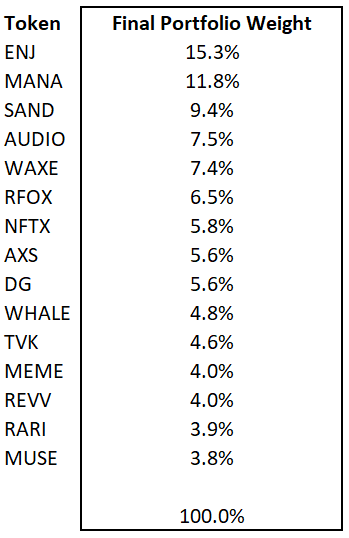

Sure, the index is launching with the weights in Exhibit 1 below and will rebalance monthly. The rebalancing will be done in two phases: the determination phase and the rebalancing phase. During the determination phase, we will assess if new tokens should be added or removed from the index. We will also be tracking daily circulating market capitalisation and aggregate liquidity data for our investment universe during this period, which feeds into the final portfolio weight determination.

Before diving into how the final weights are calculated, we wanted to highlight the screening process built into our methodology. Index Coop prides itself on building structured products based on credibly neutral, objective methodologies and MVI is no different.

We start off by screening for the following token categories on Coingecko: Non-Fungible Tokens, Entertainment, Virtual Reality, Augmented Reality and Music. It’s manual for now but we are working with Coingecko to automate the process.

After this initial screen we consider whether qualified tokens are ERC20, have circulating market cap above $30 million and have sufficient liquidity on decentralised exchanges (DEXs).

We then put the resulting tokens through further fundamental analysis. During this stage we consider if a token has been classified correctly and fits into the Metaverse narrative, if a project has plans to move to Layer 2 and how that might affect their DEX liquidity and any other considerations that might disadvantage passive holders.

This leaves us with a list of the tokens that are ready for index inclusion. The MVI uses a combination of square root of market capitalisation and liquidity weighting to arrive at the final index weights. We believe that liquidity is an important consideration. The space overall is rather nascent still and shallow liquidity complicates on-chain rebalancing and portfolio allocation.

The final index weights are calculated using the following formula:

TW = 75%*RMCW + 25%*LW

where,

TW – token weight in the $MVI

RMCW – square root of market cap weighted allocation

LW – liquidity weighted allocation

WMP

Let’s say someone’s learning about the MVI for the first time and wants to get involved somewhere around the project. Where’s the best place for them to start?

MVI team

For us as methodologists, we both ended up where we are today by contributing to the Index Coop forum and Discord with our thoughts on subjects ranging from governance to new products (the original MVI proposal went up in October!). Things in crypto work a little different to the way most are used to, you won’t be submitting a CV for a start. The best thing to do is to spot an opportunity to contribute or just add your thoughts to an ongoing discussion, things will normally snowball from there.

We’ll drop some links below but the best place to begin is probably the Discord. We have a channel dedicated to #mvi-discussion and if you are looking to get more involved you can say hi there or in the #introductions channel. You’ll be greeted there by a number of friendly Coop owls who can help point you in the right direction or just welcome you to the community!

As a DAO we have more than 40 contributors each month who are being rewarded for helping out in ways big and small. With a growing number of products to manage at Index Coop we are always looking for an extra pair of hands. If trying to make finance more accessible sounds like a goal you’re aligned with, definitely come say hello.

For MVI specifically there’s always room for memes and creative content in general. MVI is different to most DeFi products in that the integrations will go beyond using it as collateral or lending/borrowing. We would love to find productive uses for the token across the space, whether this means staking for NFTs or other unique opportunities. If you have some ideas of things we can do along these lines we’d love to hear them!

As far as our other key links go, here you can find our Twitter, Reddit, LinkedIn, Website, and Medium pages.

WMP

Where does the MVI go next? What happens to the project from here, do you think? Are the MVI builders working on anything else currently?

MVI team

We think that broader Metaverse thematic has plenty of tailwinds, from societal to economic, and will continue to grow rapidly. We are really in the very beginning of this process. It is our hope that the MVI will grow with the space and, similar to DPI, will become the default way to invest in this thematic.

At a more practical level, we will be working on a couple of things to grow MVI.

Most of the Metaverse tokens have some present of future in-game utility. MEME, for example, can be staked for pineapples which can then be redeemed for NFTs. AXS and SAND, according to their tokenomics, are designed for staking and will accrue value to the token that way. As MVI holds all of the underlying tokens, we will be working on finding a way to create utility for MVI in these underlying ecosystems.

As MVI grows, we will hold more and more of the underlying tokens. For now, few of them have formal governance through snapshot, for example. But we believe that will happen soon enough. At that point, we should be able to contribute to the governance of the underlying protocols. We plan on developing a deep understanding of their ecosystems and hope to be a valuable partner in their development going forward.

There are other ideas we are kicking around but that’s for another time!

Action steps

📰 Read the original IIP-15 Metaverse Index proposal, and check out the $MVI dashboard on TokenSets.

Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge.

🙏Thanks to our sponsor

Nifty Gateway

The all-in-one platform that makes it easy to buy, sell, and store NFTs!

Nifty Gateway works with both successful and up-and-coming artists, musicians, and brands to create limited Nifty (NFT) collections that are available on our marketplace.

👉 Visit NiftyGateway.com and start your NFT Collection today!

👉 NEW DROPS BY ZEDD, FVCKRENDER, EKAITZA & MORE OUT NOW!

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.