Green NFTs 💚

Understanding the energy efficiency of NFTs!

Metaversal is a Bankless newsletter for weekly level-ups on NFTs and the onchain frontier

Dear Bankless Nation,

NFTs have an image problem in the mainstream.

One reason? Many people think NFTs are bad for the environment.

The reality is that most NFT activity today happens atop proof-of-stake (PoS) blockchains like Ethereum, Polygon, and Solana, which use remarkably little energy.

For today’s post, let’s dive into some energy estimates here and use that as a springboard to discuss the bigger picture!

-WMP

🔮 Thanks to Kraken NFT 🔮

👉 Kraken NFT is built for secure NFT trading ✨

The New Era of Green NFTs

One of the biggest outstanding misconceptions about NFTs is that they require excessive amounts of energy.

This is a holdover from the 2021 NFT bull run, when Ethereum still ran on proof-of-work (PoW) mining. PoW was used to bootstrap Ethereum, and the physicality of mining operations is energy-intensive, but the plan all along was for Ethereum to dephysicalize by switching to PoS, i.e. ditch physical miners in favor of digital validators.

That plan was put into action in September 2022 via The Merge update, which officially shifted Ethereum to PoS. The energy savings were immediate and immense.

Indeed, according to a 2022 report by the Crypto Carbon Ratings Institute (CCRI), The Merge slashed Ethereum’s yearly energy consumption by +99.9% and its annual carbon footprint by +99.9%, making the network a decidedly green blockchain.

Additionally, a newer October 2023 report by CCRI examined the energy stats of seven PoS chains, namely Ethereum, Solana, Cosmos, Avalanche, Algorand, Cardano, and Polkadot.

Of these projects, the study found the least-consuming network was Polkadot, which matched the average annual energy consumption of ~15 U.S. households, while the most-consuming was Ethereum, which equaled the usage of ~542 U.S. households.

Equally modest were these networks’ carbon footprints, which CCRI’s 2023 report found ranged from Polkadot’s 70.8 tonnes of annual carbon dioxide (CO2) emissions to Ethereum’s 2,088.4 tonnes.

Bankless Citizens who completed the Jito quest in our Airdrop Hunter tool just earned $15k or more 🏹

Don't miss the next one 👇

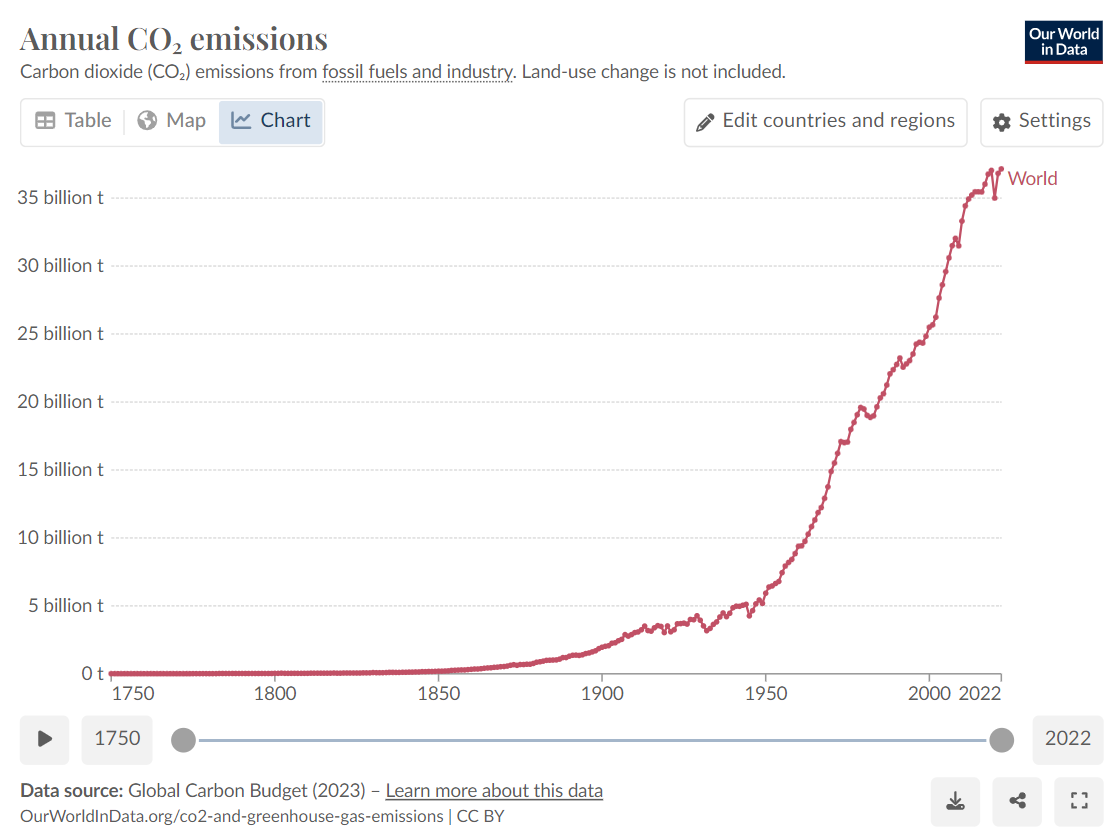

Altogether, then, these seven PoS chains notched around 4,935 tonnes of CO2 emissions in 2023. To give you a sense of scale here, a recent Our World in Data report estimated that the entire world emitted more than 34 billion tonnes of CO2 in 2022. That means the most popular PoS chains in crypto currently account for somewhere around 0.000014% of global emissions!

All that said, currently one of the most popular use cases for blockchains is NFTs, and most NFT activity today occurs on PoS chains. The reality is that the energy footprint of the contemporary NFT ecosystem is minuscule, and it pales in comparison to emissions from things like the mainstream gaming industry or the operations of global data centers.

Of course, in combination with these base PoS networks, the advent of Layer 2 (L2) scaling solutions atop chains like Ethereum means the cryptoeconomy is well-positioned to accommodate increasing amounts of extremely energy-efficient financial activity (DeFi) and cultural activity (NFTs) going forward.

This is why the “NFTs are killing the environment” chatter in the mainstream is so absurd, as the opposite is true. PoS infra + NFTs should be championed as a green alternative to physical collectibles, physical merch, etc. because they are a green alternative!

Imagine if every big touring band and every big sports team in the world replaced 10% of their physical merch offerings with digital merch via NFTs—that switch alone would lead to tremendous savings in annual CO2 emissions thanks to the cuts in manufacturing and shipping operations. It’s just the truth, whether naysayers want to accept it or not.

Here, I’m reminded of the Optimism L2’s We ❤️ The Art contest, which just fielded +7,000 NFT submissions. It didn’t entail 1,000s of artists shipping in physical canvas submissions from around the world, a process that would’ve drawn a huge carbon footprint. It happened with digital mints ultimately atop Ethereum, a network with the same annual energy consumption as a small town with a population of 1,000-1,500 people.

It’s not that everything physical has to or should be digitized as an NFT, but let’s be clear, among their other benefits PoS NFTs offer a green, environmentally friendly way to engage in 21st-century culturemaking, and that’s something that should be celebrated.

However, there has been a revival in Bitcoin NFTs since the arrival of the Ordinals tokenization method last year, and these NFTs are underpinned by PoW mining. Ordinals are technically compelling and offer a great cost-to-permanence ratio, but their energy footprint is unquestionably many multiples higher than PoS NFTs because of the extensive physicality of Bitcoin mining operations.

I suspect, and personally wish, that Bitcoin will eventually make the shift to PoS. In the meantime, Bitcoin may give ammunition to NFT critics, but that shouldn’t stop us from trumpeting the extreme energy efficiency of PoS NFTs in contrast and pushing back against blanket mischaracterizations of all NFTs as energy-intensive!

Action steps:

🌳 Read CCRI’s 2023 PoS report: The PoS Benchmark Study

🔥 Catch up on my previous write-up: Return of Ronin

📚 Collect this post: Mint it on Mirror

Author bio

William M. Peaster is the creator of Metaversal—a Bankless newsletter focused on the emergence of NFTs in the cryptoeconomy. He also serves as a senior writer for the main Bankless newsletter.

🙏 Together with 🔮 Kraken NFT 🔮

KRAKEN NFT

Kraken NFT is one of the most secure, easy-to-use and dynamic marketplaces available. Active and new collectors alike benefit from zero gas fees, multi-chain access, payment flexibility with fiat or 200+ cryptocurrencies, and built-in rarity rankings. Learn more at Kraken.com/nft

👉 Visit Kraken.com to learn more and open an account today.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.