Emblem Vaults Explained 💎

How to trade NFTs across blockchains!

Metaversal is a Bankless newsletter for weekly level-ups on NFTs, virtual worlds, & collectibles

Dear Bankless Nation,

Earlier today I published a Bankless Tactic guide on “How to Mint a Bitcoin NFT.”

In the post, I walk through how to use the Xverse wallet + Gamma combo to simply create your first Bitcoin NFT.

But what about after minting?

There’s a new wave of Bitcoin NFT marketplaces rising up where you can try to sell your creations, but the scene and UX is very early.

As such, many Bitcoin NFTers have been turning to Emblem Vaults, a cross-chain NFT trading solution that’s been gaining traction over the past couple of years in line with surging interest around historic NFTs on Ethereum.

For today’s post, let’s complement the aforementioned minting tactic by getting you up to speed on the basics of Emblem Vaults!

-WMP

🙏 Thanks to our sponsor MetaMask Learn

👉 Add MetaMask Learn to your onboarding guides for your community ✨

Emblem Vaults: a quick intro

The 101

Emblem Vaults are ERC721 or ERC1155 NFTs that are used to effectively store and exchange assets across a range of different blockchains without the use of bridging.

In this way, these NFT “vaults” act as transferable multi-asset wallets that are able to contain both fungible and non-fungible tokens. They can also facilitate activity across chains regardless of whether they’re compatible with the Ethereum Virtual Machine (EVM) or not.

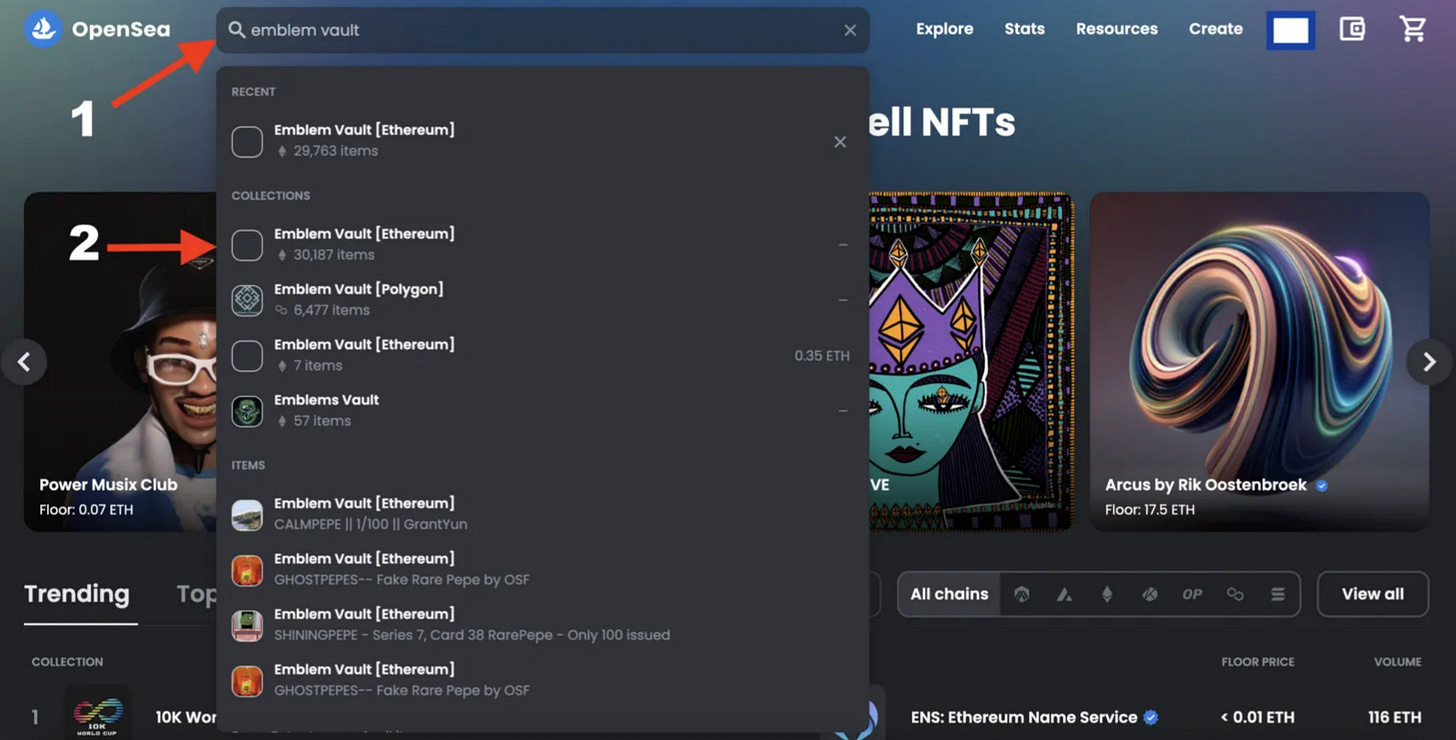

First unveiled in September 2020, Emblem Vaults have since become the leading solution for trading historical NFTs from non-EVM chains like Bitcoin and Dogecoin on Ethereum’s contemporary NFT marketplaces, e.g. OpenSea. Notably, 30,000 unique vaults have been created to date, from which over Ξ40,000 worth of trading volume has been facilitated since December 2022.

How it works

“Technically speaking, an Emblem Vault is an NFT. We describe it as if that NFT ‘contains’ a whole wallet full of assets, like a piggy bank, and then that entire piggy bank can get passed around as a single asset.” — What IS An Emblem Vault?

The NFT that represents a particular vault includes access to a series of blockchain addresses that have been created from a single, unique seed. During the “unclaimed” vault state anyone is able to send assets, like NFTs, to these addresses but no one can withdraw the assets because the underlying private keys remain totally hidden at this point.

Accordingly, a vault NFT can be transferred or traded with its unclaimed contents inside. After purchase, a buyer is able to unlock the private keys, access the contents inside, and then move the assets into any other wallets that they wish. Upon being claimed, vault NFTs become non-transferable so they can’t be used by another person.

Supported chains

When you purchase a vault NFT, you purchase the ability to burn that vault and thereafter take control of its associated private keys, which are numbered at 20 per vault currently. That’s because right now Emblem Vaults support 20 blockchain integrations, which are as follows:

Walkthrough guides

While vaulting assets with Emblem Vaults is generally the same process across chains, vaulting Ordinals-style Bitcoin NFTs does have unique steps you need to be aware of. A great guide to get you up to speed on the nuances of this process comes via historical NFT collector obi:

However, as we’ve mentioned already, Emblem Vaults support many more chains than just Bitcoin. Here are a handful of guides on the other biggest integrations to date if you want to learn how these flows work:

🟠 Counterparty — How to vault | How to unlock NFTs | How to use with OpenSea

🐕 Dogecoin / Dogeparty — How to vault | How to unlock NFTs | How to use with OpenSea

🌱 Namecoin — How to vault | How to unlock NFTs | How to use with OpenSea

A couple additional primers you might want to review:

How to use safely

So you’re diving deeper into Bitcoin NFTs and you’re keen to trade these new Ordinals-style through Emblem Vaults. That’s awesome, but just don’t be careless here.

That’s because if you don’t pay close enough attention during the buying process you might end up buying imposter NFTs. To get a feel for how to know what you actually stand to receive with Ordinals Emblem Vaults, check out the thread above by Adam McBride, an Emblem team member, to learn how to quickly vet these vaults on your own.

With so much buzz around Bitcoin NFTs lately, scammers are on the prowl. Always vet your vaults so these predators can’t get you to FOMO into lookalike junk!

The big picture

Back in February 2021, a PEPECASH card became the first Bitcoin-based NFT to sell on Ethereum through an Emblem Vault. Fast forward two years later and now this same system is facilitating hundreds if not thousands of daily Bitcoin NFT transactions on OpenSea. This all, of course, comes as the current Bitcoin NFT boom is barely one month old.

As this new NFT scene continues to grow, Emblem’s activity levels stand to rise for the foreseeable future as this system both supports this growth and shows more people they can take their NFT storage and trading activities cross-chain in fairly straightforward fashion.

Action steps

Check out Emblem Vaults: see the Emblem app and the OpenSea Emblem Vaults page for yourself 💎

Learn how to mint your own Bitcoin NFTs: review my latest Xverse + Gamma guide 🟠

Author Bio

William M. Peaster is a professional writer and creator of Metaversal—a Bankless newsletter focused on the emergence of NFTs in the cryptoeconomy. He’s also recently been contributing content to Bankless, JPG, and beyond!

Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge.

🙏 Together with 🦊 MetaMask Learn 🦊

MetaMask Learn is an educational resource to help people understand what web3 is, why it matters, and how to get started. While you may understand core concepts of this decentralized technology, many don’t—consider adding MetaMask Learn to your onboarding guides if you’re a dapp developer or NFT creator to give your community the welcome they deserve.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.